Contents

- AP and AR Automation Explained

- What is the difference between accounts receivable AR and accounts payable AP?

- AP Automation

- What is an Accounts Receivable Software?

- Leveraging Payments API for Streamlined Processes

- What are Some Common Use Cases of RPA in Finance?

- Harnessing the Power of AI and ML for Automating the Financial Industry

- Benefits of Automating Both AP and AR With Accounting Software

- What is AR reconciliation?

- What is a 3-way Invoice Reconciliation Process?

- To sum up

AP and AR Automation Explained

Many have turned to automation, especially in accounts payable (AP) and accounts receivable (AR) operations, to improve efficiency and accuracy. This shift involves not only adopting new technologies but also rethinking how financial transactions can be managed with minimal human intervention.

Automation in AP and AR not only streamlines workflows but also introduces a level of precision and speed that was previously unattainable through manual processes. Automating critical financial operations can reduce errors, save time, and ultimately improve a business’s bottom line. This exploration of AP and AR automation will demonstrate how these technologies transform traditional finance roles into strategic, data-driven functions.

What is the difference between accounts receivable AR and accounts payable AP?

Before we proceed, it is essential to differentiate between accounts receivable (AR) and accounts payable (AP), as they represent opposite ends of the financial spectrum for any business. In simple terms, AR refers to the money owed to a company by its customers for goods or services delivered, which is a crucial component of its revenue stream.

Conversely, AP represents the company’s obligations to pay off short-term debts to its suppliers or creditors. Understanding this distinction is crucial as we explore how automation benefits each aspect, helping businesses manage their cash flow more effectively.

AP Automation

The realm of AP automation is transformative, redefining traditional processes to enhance efficiency and accuracy. Automation enables businesses to establish recurring payments, ensuring that regular suppliers are paid on time, without the need for manual oversight.

The process of invoice matching becomes seamless, as RPA tools automatically compare incoming invoices against purchase orders and receipts, flagging any discrepancies for human review.

This automation speeds up payment approvals while maintaining control and oversight.

Additionally, it matches invoices to payments and deposits, ensuring that every transaction is accounted for.

Automating these processes leads to significant cost savings by reducing manual labor involved in payment processing, thereby decreasing the overall cost of managing payables.

What is an Accounts Receivable Software?

On the other hand, accounts receivable software is a powerful tool that automates billing and collection processes. It streamlines invoice creation, tracks outstanding payments, and sends payment reminders to customers efficiently. Automating these tasks helps businesses ensure timely collections, maintain a healthy cash flow, and minimize the time spent chasing overdue payments. The AR software not only simplifies receivables management but also provides valuable insights into customer payment behaviors, helping businesses refine their credit policies and collection strategies.

It automates payment management and collection, featuring:

- Sets up payment reminders: Automatically alerts customers about upcoming and overdue payments.

- Sends payment processing: Facilitates the efficient processing of incoming payments.

Leveraging Payments API for Streamlined Processes

The technology that enables AP and AR automation is Payments API. This integration allows for real-time payment initiation and tracking, providing businesses with a transparent view of their financial transactions.

By using Payments API, companies can automate invoice creation and sending, directly initiate payments to vendors, and track transactions in real-time. This integration and automation level guarantees streamlined, secure, and efficient financial operations, giving businesses better control over their cash flow and financial obligations.

Payments API technology supports both AP and AR automation by enabling:

- Real-time payment initiation and tracking: Offers a transparent view of payment statuses.

- Creates and sends invoices: Automates invoice generation and distribution.

What are Some Common Use Cases of RPA in Finance?

RPA stands out as a game-changer, breathing new life into traditional financial operations. It’s like having a digital workforce at your fingertips, ready to take on the meticulous tasks that once bogged down finance professionals. From enhancing data accuracy to ensuring timely financial reporting, RPA’s applications in finance are as diverse as they are transformative. Let’s dive into some of the standout uses of RPA that are reshaping the financial landscape:

- Automated Reading of Bills and Invoices: Imagine a world where piles of bills and invoices sort and process themselves, where data flows from documents into databases without a single keystroke. That’s the reality RPA brings to finance departments. By automatically extracting data from various financial documents, RPA tools eliminate the drudgery of manual data entry, slashing processing times and virtually eradicating entry errors. This automation not only speeds up operations but also frees finance teams to focus on more strategic tasks that require human insight.

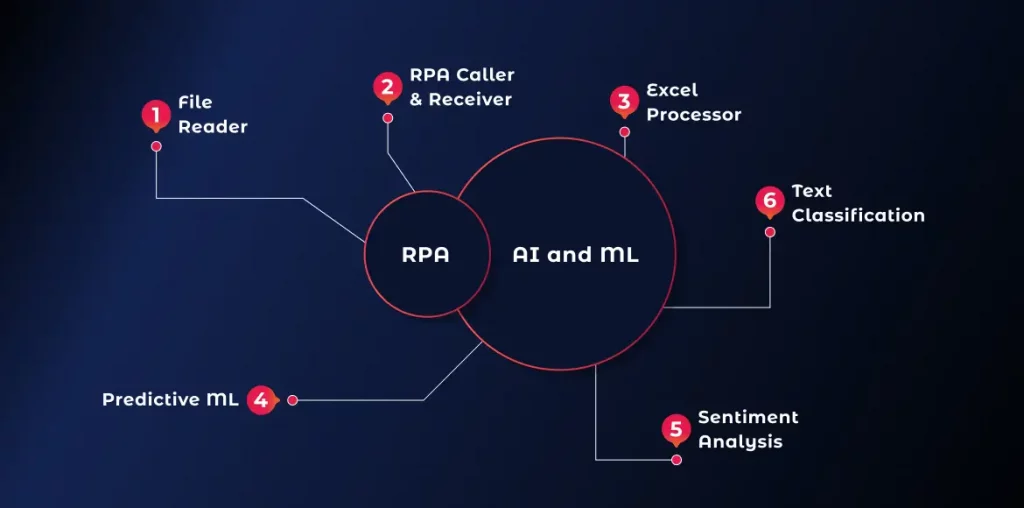

Harnessing the Power of AI and ML for Automating the Financial Industry

The integration of Artificial Intelligence (AI) and Machine Learning (ML) with Robotic Process Automation (RPA) unlocks a new dimension in financial operations. It boosts the power and efficiency of financial processes, revolutionizing the industry and enhancing the roles of those who perform them. Let’s explore the remarkable benefits of this combination:

- Efficiency Gains and Reduced Manual Work: AI and ML empower RPA to automate complex and time-consuming tasks, enabling the analysis of trends and patterns for smarter decision-making and strategic planning. This liberates employees from manual work, allowing them to focus on more meaningful, value-adding activities. The goal is not just to do things faster, but to do them smarter.

- Execution of Vendor Payments: When it comes to paying vendors, accuracy and timeliness are crucial. Integrating AI and ML with RPA can improve these processes, ensuring flawless and timely payments. This technology can predict the best time for payments, manage cash flows more efficiently, and even negotiate better terms based on payment history analysis. The result is a smoother, more efficient financial operation that keeps vendors satisfied and balance sheets healthy.

- Increased Productivity for Employees: Eliminating dreary, repetitive tasks can stifle creativity and diminish morale. However, AI and ML-enhanced RPA solutions give employees the freedom to focus on creative problem-solving and strategic initiatives. This shift boosts productivity and fosters a more engaging and satisfying work environment. Employees can invest their energy into areas where they make the most impact, driving innovation and growth.

The integration of AI, ML, and RPA represents a paradigm shift in the financial industry, rather than just an incremental improvement. This collaboration between technology and human ingenuity creates more resilient, agile, and intelligent financial operations, heralding a new era. The potential is limitless, from transforming customer experiences to redefining competitive edges. As we continue to explore and expand these technologies, the future of finance appears not only automated but also significantly more intelligent.

Benefits of Automating Both AP and AR With Accounting Software

Embracing automation in both Accounts Payable (AP) and Accounts Receivable (AR) through accounting software sets the foundation for a strong financial system in your business. This approach brings numerous benefits that can transform financial operations.

- Improved Cash Flow Management: One crucial aspect of financial stability is the effective management of cash flow. Automating accounts payable (AP) and accounts receivable (AR) processes can provide businesses with better control over their financial operations, allowing them to forecast and manage cash flow more precisely. With this approach, businesses can gain a clear view of their financial landscape, anticipate cash shortages and surpluses, and plan accordingly to ensure their financial robustness.

- Enhanced Visibility and Control: Automation offers a detailed view of your AP and AR processes, allowing you to make informed decisions, identify optimization opportunities, and detect potential issues before they become problems. It is similar to having a financial dashboard that provides a comprehensive view of your operations, enabling you to guide your business with confidence and accuracy.

What is AR reconciliation?

Navigating the world of Accounts Receivable (AR) reconciliation is like piecing together a complex puzzle. It requires ensuring that every piece fits perfectly to reveal the bigger financial picture of your business. At its core, AR reconciliation ensures that the money businesses expect to receive from clients matches the actual incoming payments. Let’s delve deeper into the key components that make AR reconciliation a critical yet manageable task.

- Sets up reminders for client payments: Timely collections are crucial for any business. Setting up automatic reminders for client payments can encourage timely payments and reduce the time spent chasing down receivables. A system that keeps track of all due payments and sends out reminders automatically can ensure a steady cash flow without any effort on your part.

- Integration with existing systems: In today’s interconnected business environment, it is essential to integrate AR reconciliation tools with existing business systems, such as CRM and ERP software, to create a seamless flow of information. This connectivity ensures that all departments have up-to-date financial data, facilitating better decision-making and strategic planning. It’s like having a symphony orchestra where every instrument plays in perfect harmony, contributing to a flawless performance.

- Accepts online payment: In today’s world, providing simple online payment options can greatly improve customer satisfaction and speed up the payment process. By incorporating online payment solutions into the accounts receivable process, businesses can offer their customers a stress-free method of paying their bills, resulting in faster collections and better cash flow. Imagine a situation where customers can easily pay their invoices with just a few clicks, at any time and from any location, eliminating the possibility of late payments.

What is a 3-way Invoice Reconciliation Process?

The 3-way invoice reconciliation process is a crucial control mechanism in accounting and procurement. It ensures that payments made to suppliers are accurate and justified. This process involves three key documents: the purchase order (PO) issued by the buyer, the delivery receipt confirmed by the receiving department, and the invoice received from the supplier. Here’s how it works:

- Purchase Order (PO): The buyer creates a PO that outlines the types and quantities of products or services ordered.

- Delivery Receipt: Upon receiving the goods or services, the receiving department issues a delivery receipt that confirms what was received matches the PO.

- Invoice Matching: The final step involves comparing the supplier’s invoice against the PO and the delivery receipt. If all three documents align in terms of quantity, price, and terms, the invoice is approved for payment.

This thorough process reduces the chance of overpayments or paying for undelivered goods, promoting trust and transparency between businesses and their suppliers. To streamline this process, studies such as those by the Institute of Finance & Management (IOFM) suggest automating the 3-way reconciliation process to improve efficiency and reduce errors.

To sum up

By embracing the automation of accounts payable (AP) and accounts receivable (AR) workflows, companies can revolutionize their operational efficiency, precision, and overall financial wellness. The synergy of Robotic Process Automation (RPA) with the analytical power of Artificial Intelligence (AI) and Machine Learning (ML) represents a significant leap towards redefining the future of the financial sector. This fusion marks the beginning of a new era of innovation, providing businesses with a significant advantage in the highly competitive market.

Interested in taking the first step towards transforming your finance operations with the power of automation? Dive into our comprehensive suite of RPA Services at Scimus, designed to streamline your financial workflows and unlock efficiency gains like never before. Additionally, our insights on Accounting Software Automation explore cutting-edge strategies to automate both AP and AR processes, ensuring your business remains at the forefront of financial management excellence.

For those keen on delving deeper into the role of RPA in finance and understanding its broader implications, external resources such as Deloitte’s insights on RPA and Gartner’s research on AI and ML in finance offer a wealth of valuable information. These resources provide a comprehensive overview of the current trends, challenges, and opportunities presented by RPA, AI, and ML in the financial industry.

Stay ahead of the curve by exploring these essential tools and resources. Visit our Scimus blog for more insightful articles and guides on leveraging technology to empower your financial operations and drive business success.