By automating manual processes and repetitive tasks, RPA not only enhances efficiency and accuracy but also significantly reduces the likelihood of human error. This technological leap promises a transformative impact on data entry, financial reporting, and regulatory compliance, making it an indispensable asset for modern financial departments seeking optimization and innovation.

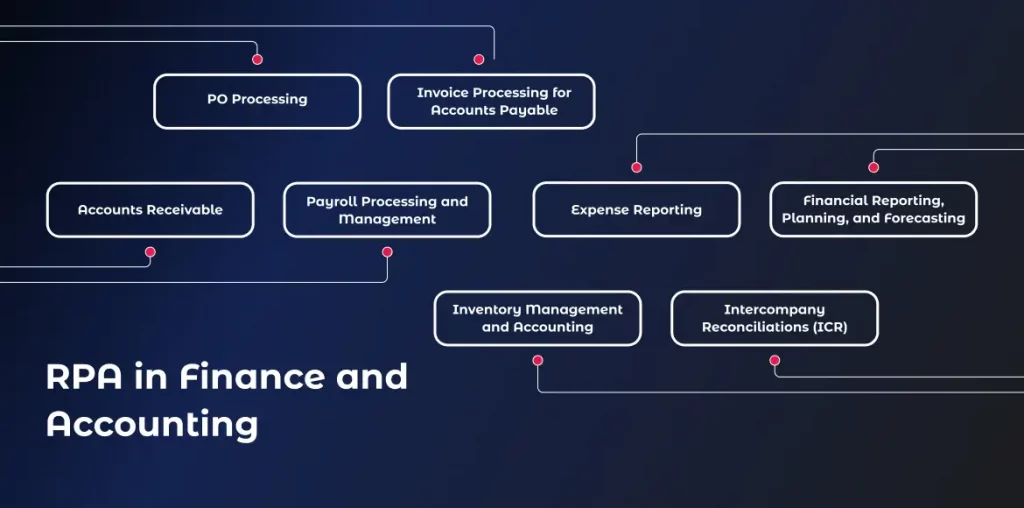

Comprehensive Use Cases of RPA in Finance and Accounting

PO Processing

RPA significantly enhances PO Processing by automating the entire cycle from purchase request approval to order placement and invoice matching. Bots can validate purchase requests against budget allocations and vendor performance, automatically generate and send purchase orders, and reconcile invoices upon goods receipt. This automation reduces procurement cycles, minimizes paperwork, and ensures financial controls are maintained, leading to cost savings and operational efficiency.

Invoice Processing for Accounts Payable

In the realm of Accounts Payable, RPA transforms Invoice Processing by automatically extracting invoice data, matching it with POs and receipts, and executing payments. This process minimizes delays, prevents overpayments, and combats fraud. Moreover, RPA can flag discrepancies for human review, ensuring that only legitimate, accurate payments are processed, thereby enhancing data accuracy and financial reporting.

Accounts Receivable

RPA boosts Accounts Receivable efficiency by automating invoice creation, sending reminders for overdue payments, and applying cash receipts to customer accounts. This not only accelerates cash flows but also improves customer service through timely and accurate billing. Furthermore, RPA analytics can identify trends in payment behaviors, aiding in risk assessment and decision-making processes.

Payroll Processing and Management

Payroll Processing benefits from RPA through the automation of salary calculations, deductions, tax withholdings, and payment distribution. By ensuring compliance with tax regulations and industry standards, RPA minimizes manual errors and enhances employee satisfaction with timely and accurate salary payments.

Expense Reporting

RPA simplifies Expense Reporting by automating expense submission, approval workflows, and reimbursements. Employees can upload receipts, and bots can verify them against company policies, automatically approve within thresholds, and process reimbursements, reducing the administrative burden and improving employee experience.

Financial Reporting, Planning, and Forecasting

RPA plays a crucial role in Financial Reporting by gathering data from various sources, generating reports, and distributing them as needed. This automation supports financial planning and forecasting by providing timely, accurate financial data, enabling strategic decision-making. Moreover, bots can perform variance analysis and highlight trends, offering insights into financial performance and opportunities for improvement.

Inventory Management and Accounting

In Inventory Management, RPA automates stock level monitoring, reordering, and accounting for inventory changes. This ensures optimal stock levels, reduces carrying costs, and improves the accuracy of cost of goods sold calculations, contributing to better financial performance and operational efficiency.

Intercompany Reconciliations (ICR)

Intercompany Reconciliations are streamlined with RPA by automating the matching of transactions across different business units, identifying discrepancies, and facilitating adjustments. This automation speeds up the monthly close process, enhances data accuracy, and supports regulatory compliance by ensuring financial statements accurately reflect the company's financial position.

Specialized Applications of RPA

RPA in KYC

RPA significantly streamlines the Know Your Customer (KYC) processes, a critical aspect of regulatory compliance and customer onboarding in the financial sector. By automating data collection, verification, and analysis, RPA reduces the time and resources required for KYC checks, enabling faster onboarding of new clients while ensuring compliance with anti-money laundering (AML) and counter-terrorism financing (CTF) regulations. RPA can:

- Automatically gather customer data from various data sources.

- Validate the information against internal and external databases.

- Generate compliance reports for review.

- Update customer records with KYC verification status.

This automation not only enhances operational efficiency but also significantly reduces the risk of human error, making the KYC process both more reliable and more cost-effective. Studies and reports indicate that RPA can reduce the time spent on KYC compliance by up to 80%, demonstrating a substantial impact on the financial institution's operational lags and cost reduction efforts.

Regulatory Compliance

In the context of Regulatory Compliance, RPA offers a transformative solution for financial institutions navigating the complex landscape of legal and financial standards. By automating the collection, analysis, and reporting of regulatory data, RPA ensures that institutions can meet their compliance obligations more efficiently and with greater accuracy. Key benefits include:

- Automated data collection from multiple information systems, ensuring comprehensive compliance reporting.

- Real-time monitoring and reporting of compliance violations, facilitating swift corrective actions.

- Simplification of compliance reporting processes, making it easier to adhere to regulatory requirements and industry standards.

Furthermore, RPA's capability to adapt to regulatory changes dynamically allows financial institutions to stay ahead of compliance requirements, minimizing the risk of penalties and reputational damage. By leveraging RPA for regulatory compliance, institutions can not only ensure adherence to regulations but also reallocate resources towards strategic tasks, enhancing overall business processes and operational efficiency.

Using RPA in Finance and Accounting: Benefits and Challenges

Benefits

- Increased Efficiency and Productivity: RPA automates time-consuming tasks such as data entry, invoice processing, and financial report generation, freeing up staff to focus on more strategic activities.

- Improved Accuracy: Automation reduces the risk of human error in financial transactions and reporting, enhancing the reliability of financial data.

- Cost Savings: By automating routine tasks, RPA can lead to substantial cost savings, reducing the need for additional staffing for manual data processing and analysis.

- Scalability: RPA can easily scale to handle peak loads or additional processes without significant increases in cost or resources.

- Enhanced Compliance: Automated processes ensure adherence to regulatory requirements and compliance standards, reducing the risk of financial penalties.

- Customer Satisfaction: Faster processing times and more accurate data improve service levels and customer satisfaction.

Studies and reports have highlighted the potential of RPA to achieve up to a 65% reduction in the time required for financial close processes and a 30-70% cost reduction in accounts payable and receivable operations.

Challenges

- Implementation Costs: Initial setup and customization of RPA solutions can be high, especially for complex integrations with existing systems.

- Change Management: The adoption of RPA requires significant organizational change management to realign processes and retrain staff, which can be a substantial hurdle.

- Integration with Legacy Systems: Integrating RPA with older, legacy systems can be challenging and may limit the automation capabilities.

- Maintaining and Updating Bots: RPA bots require ongoing maintenance and updates to adapt to changing business processes and regulatory requirements, necessitating continuous investment.

- Scalability and Flexibility Issues: While RPA is scalable, finding the right balance between automation and human intervention can be challenging, especially for processes that require frequent updates or personal judgment.

- Security Concerns: Managing sensitive financial data through RPA raises concerns about data security and data governance, requiring robust security measures.

The Future of Finance: Harnessing the Power of AI and ML

The integration of Artificial Intelligence (AI) and Machine Learning (ML) with Robotic Process Automation (RPA) is paving the way for a new era in finance and accounting. This fusion enhances RPA capabilities, allowing for not only the automation of routine tasks but also the introduction of advanced analytical capabilities and insights-driven decision-making.

- Predictive Analytics: AI and ML empower RPA systems with predictive analytics, enabling financial institutions to forecast future trends, manage risks more effectively, and identify opportunities for growth. For instance, predictive models can forecast cash flow scenarios, helping businesses optimize their financial planning and liquidity management.

- Intelligent Decision-Making: AI-enhanced RPA tools can analyze vast amounts of data in real-time, providing finance professionals with actionable insights for strategic decision-making. This can significantly improve investment strategies, risk management practices, and customer service offerings.

- Enhanced Fraud Detection: ML algorithms can learn from historical transaction data to identify patterns indicative of fraudulent activities. When integrated with RPA, these systems can automatically flag suspicious transactions for review, greatly enhancing an organization's ability to prevent fraud.

- Advanced Customer Service: AI can augment RPA solutions in customer-facing applications, such as chatbots and virtual assistants, providing personalized financial advice and support to clients around the clock.

- Process Optimization: ML can analyze the performance of RPA bots, identifying inefficiencies and optimizing workflows for improved productivity. This continuous improvement cycle ensures that automation processes remain efficient and aligned with business objectives.

Studies and references, such as the Deloitte Insights report on AI and ML in finance, highlight the potential for these technologies to drive cost savings, improve accuracy, and create new service models that were previously unimaginable.

For example, J.P. Morgan’s COIN platform uses ML to interpret commercial loan agreements, a task that previously consumed 360,000 hours of work each year, now performed in mere seconds.

Real-World Examples of RPA in Finance

Here are some illustrative case studies showcasing the successful implementation of RPA in the financial sector:

- Banking Sector - KYC Process Automation: A leading global bank implemented RPA to automate its Know Your Customer (KYC) processes. By leveraging RPA, the bank reduced the average handling time per customer from several days to just a few hours, resulting in a 70% efficiency gain. This automation also enhanced customer satisfaction by speeding up onboarding processes and improving data accuracy.

- Insurance Company - Claims Processing: An insurance company utilized RPA to automate its claims processing system. This not only accelerated the claims handling process but also reduced manual errors and improved data governance. The result was a 50% reduction in processing time and a significant increase in customer satisfaction levels.

- Financial Services - Invoice Processing: A financial services provider automated its accounts payable department with RPA, streamlining invoice processing and vendor payments. The implementation led to an 80% reduction in invoice processing costs and a 90% improvement in processing speed, demonstrating RPA's potential to drastically reduce operational costs and enhance efficiency.

- Asset Management Firm - Regulatory Compliance Reporting: By implementing RPA for regulatory compliance reporting, an asset management firm was able to automate the collection and compilation of complex financial data required for compliance reports. This not only ensured regulatory compliance but also freed up significant resources, allowing the firm to focus on core activities and strategic decision-making.

- Retail Banking - Account Reconciliation: A retail bank applied RPA technology to automate its end-of-day account reconciliation processes. The automation of these time-consuming tasks led to a dramatic decrease in reconciliation errors, a 60% reduction in processing time, and enhanced operational efficiency across the board.

How RPA Accounting Benefits Enterprise-scale Companies

The integration of RPA within large organizations' finance departments ushers in an era of unprecedented efficiency, accuracy, and regulatory compliance. Here's how:

Scalability

RPA offers scalable solutions that grow with the enterprise. As businesses expand, the volume of transactions and the complexity of financial operations increase exponentially. RPA systems can be scaled up to handle a higher volume of transactions without the need for proportional increases in human resources or infrastructure. This scalability ensures that companies can manage growth efficiently, maintaining or even reducing operational costs while expanding their operations.

- Case Point: A multinational corporation implemented RPA for data entry and invoice processing, enabling the handling of thousands more invoices per month without additional hires, showcasing RPA's scalability.

Accuracy

Financial accuracy is paramount for any organization, but it becomes critically important and challenging for enterprise-scale companies due to the sheer volume of transactions. RPA significantly reduces human error in financial transactions, data analysis, and reporting. Automated systems perform tasks with consistent precision, ensuring that financial records are accurate, which is crucial for financial planning, forecasting, and decision-making processes.

- Impact: An enterprise adopting RPA for financial report generation witnessed a dramatic reduction in discrepancies, boosting stakeholder confidence in financial data.

Compliance

Regulatory compliance is a complex area, especially for large organizations operating across different jurisdictions. RPA can automate the monitoring and reporting processes required for compliance, ensuring that enterprises stay ahead of regulatory changes and avoid penalties. By automating compliance reporting and data governance, RPA ensures that enterprises can easily adapt to new or updated regulatory requirements without extensive manual intervention.

- Example: A global finance company used RPA to automate its regulatory compliance processes, cutting down the time required to compile compliance reports by over 50% and significantly reducing the risk of non-compliance penalties.

Data Governance: Ensuring Integrity and Security

Data Governance has become paramount for organizations, especially in finance and accounting. Robotic Process Automation (RPA) plays a pivotal role in bolstering data governance strategies by ensuring data quality and security of sensitive financial information. Here’s how RPA contributes to robust data governance:

- Automated Data Validation and Cleansing: RPA bots can automatically validate incoming data for accuracy and completeness, perform data cleansing activities to ensure that the financial data used in reporting and analysis is both reliable and of high quality. This automation significantly reduces the risk of data discrepancies that can lead to financial misstatements or errors in decision-making.

- Enhanced Data Security: With the automation of data entry and processing tasks, RPA minimizes human interaction with sensitive data, thereby reducing the risk of data breaches. Furthermore, RPA solutions are designed with robust security features that ensure data is encrypted and securely handled, adhering to data protection laws and regulatory requirements.

- Audit Trails for Compliance: RPA systems inherently create detailed logs of all transactions and data manipulations, providing an immutable audit trail. This feature is invaluable for ensuring compliance with financial regulations and standards, facilitating easier audit processes, and providing transparency into financial operations.

- Consistent Data Management Practices: RPA enforces consistent application of data governance policies across the organization by automating data handling and processing tasks according to predefined rules. This consistency ensures that all financial data is managed, stored, and destroyed in compliance with data governance standards and regulatory requirements.

- Real-time Data Monitoring: RPA enables real-time monitoring of data quality and governance metrics, allowing organizations to identify and rectify data governance issues promptly. This proactive approach to data governance not only ensures the integrity and security of financial data but also enhances the overall agility of the finance department.

The Transformative Impact of RPA

Robotic Process Automation (RPA) has significantly advanced finance and accounting departments, automating tasks, improving accuracy, and ensuring compliance. Its integration with Artificial Intelligence and Machine Learning heralds a future of even more sophisticated financial analysis and decision-making, enhancing strategic capabilities.

- RPA's scalability benefits organizations of all sizes, promising to level the competitive field in finance. The evolution towards self-learning bots will further enhance operational efficiency and strategic agility, making financial operations smarter and more compliant.

- As RPA continues to evolve, its transformative impact on finance is undeniable, offering a competitive edge through improved efficiency and innovation. Organizations looking to leverage RPA can explore more on our Scimus website and gain insights from the Scimus Blog.

RPA is not just reshaping finance and accounting by doing tasks faster but also by setting new standards of excellence and innovation, underscoring its pivotal role in the industry's future.

0 thoughts on "RPA in Accounting and Finance: Unveiling the Benefits"