Integrating payment solutions like Worldpay or Stripe is key for clinics aiming to modernize their billing systems and meet patient expectations. These platforms enable clinics to accept payments via credit cards, digital wallets, and bank transfers while ensuring compliance with PCI DSS and HIPAA regulations. Here's a quick summary of what you need to know:

- Evaluate Your Current Systems: Assess your clinic's software (EHR, PMS, etc.) for compatibility with Worldpay or Stripe.

- Regulatory Compliance: Ensure adherence to PCI DSS v4.0.1 (effective since June 2024) for cardholder data and HIPAA for patient information.

- Integration Steps:

- Use tools like Stripe Elements or Worldpay's triPOS Direct for secure, compliant setups.

- Avoid handling raw card data by leveraging tokenization and hosted payment solutions.

- Technical Requirements: Configure APIs, set up webhooks for real-time updates, and test integrations thoroughly before going live.

- Security Best Practices: Use TLS encryption, network segmentation, and audit logs to safeguard sensitive data.

- Staff Training: Educate employees on compliance and secure payment handling.

Planning Your Payment Integration

Assessing Your Clinic's Current Systems

Before integrating with Worldpay or Stripe, take stock of your clinic’s current payment-related systems. Create a detailed list of all platforms involved in patient payments - this could include your Electronic Health Records (EHR), Practice Management System (PMS), patient portals, accounting tools, or telehealth platforms. This inventory will help you identify where payment processing needs to connect and which systems must work together seamlessly.

Check if your existing platforms offer built-in support for Stripe or Worldpay. Many modern tools, such as WooCommerce and FormDr, provide straightforward "no-code" integration options, making setup easier. If your software lacks these ready-made connectors, ensure your server supports programming libraries like Ruby, Python, or Node.js, and confirm that your frontend can securely load Stripe.js.

For clinics handling in-person payments, confirm that your card readers are compatible with Stripe Terminal. Also, determine where Protected Health Information (PHI) is stored within your systems. Since Stripe does not sign Business Associate Agreements (BAAs) for its core payment services, it’s crucial to isolate PHI from payment APIs to remain compliant.

Once you’ve mapped out your systems, focus on meeting the specific regulatory requirements for healthcare payment processing.

Understanding Business and Compliance Requirements

Healthcare providers in the United States must comply with both PCI DSS for card data security and HIPAA for protecting patient information. These two sets of requirements operate independently but are equally important. Stripe is certified as a PCI Level 1 Service Provider, which is the highest standard for payment security. However, this certification does not cover HIPAA compliance.

Under Section 1179 of the Social Security Act, HIPAA provides a payment processing exemption, allowing clinics to use services like Stripe as long as these systems only facilitate fund transfers and do not handle PHI beyond what’s absolutely necessary. To stay within this exemption, configure your systems to use generic descriptions like "Clinic Payment" or "Office Visit" on statements and invoices. Avoid including specific procedure codes, diagnoses, or treatment details.

Your integration should also support common healthcare payment types, including copays, deductibles, subscription services, and HSA/FSA cards. To minimize PCI compliance risks, use tokenization through hosted UI components like Stripe Elements or Checkout. This ensures that raw card data never touches your clinic’s servers. Additionally, employ random IDs to decouple patient information from transaction data.

If these steps feel overwhelming or your system setup is particularly complex, it may be time to bring in professional help.

When to Partner With Experts

If your clinic lacks the internal resources to manage legacy system integration or complex customizations, it’s wise to seek expert assistance. Professionals can help you navigate challenges, especially when bridging modern APIs with older workflows.

One of the biggest hurdles is ensuring PHI remains completely separate from the payment gateway. Kevin Henry, a HIPAA specialist at Accountable, warns:

Stripe is not a HIPAA-compliant service for handling Protected Health Information (PHI) and, as of December 2025, does not publish or offer a Business Associate Agreement (BAA).

Integrating legacy systems requires careful planning to design workflows that keep clinical details out of the payment processor. Companies like Scimus specialize in creating custom solutions that achieve this while maintaining a smooth user experience.

For clinics that need to handle raw, untokenized card data directly, the compliance burden becomes even greater. PCI DSS mandates over 300 security controls, and you may need external auditors for annual assessments. Scimus also offers ongoing quality assurance testing and support to ensure your integration remains compliant as regulations change and your practice evolves.

Technical Integration With Stripe

Setting Up Stripe for US Clinics

To get started with Stripe, you'll need to create an account using your US business details, such as your EIN and bank account information. Stripe will verify your identity during this process.

Once your account is active, head over to the Stripe Dashboard to configure your statement descriptor - this is the text patients will see on their bank statements. Keep it clear and concise, with up to 22 characters. For example, use something like "CLINIC* VISIT" or "HEALTHCARE* ABC" to minimize confusion and reduce the likelihood of disputes. You’ll also need to set up your payout schedule and link your bank account.

Next, locate your API keys in the Developers section of the Stripe Dashboard. There are two types: a Publishable key for your frontend and a Secret key for backend operations. While the Publishable key can safely be included in your website or app, the Secret key must always remain secure on your server.

Integrating Stripe With Clinic Software

The recommended way to integrate Stripe is by using the Payment Intents API, which manages the entire payment process and handles advanced authentication methods like 3D Secure. This approach also helps avoid duplicate charges.

Here’s how the integration works:

- Install the Stripe library for your server environment. Stripe supports various programming languages, including Ruby, Python, and Node.js. Initialize the library with your Secret key.

- When a patient is ready to pay, create a

PaymentIntenton your server. Specify the amount in cents (e.g., $10.00 is1000) and set the currency tousd. - On your checkout page, load

Stripe.jsdirectly fromhttps://js.stripe.comto ensure PCI compliance. Use your Publishable key to initialize Stripe.js, then create a securePaymentElementiframe with Stripe Elements. This setup ensures that sensitive card details go directly to Stripe’s servers, bypassing your clinic’s infrastructure. - Once the patient submits payment, call

confirmPaymenton the client side to complete the transaction.

To stay informed about payment events, implement webhooks on your server. These will notify you of events like payment_intent.succeeded or payment_intent.payment_failed. Webhooks are more reliable than client-side callbacks, which might fail if the patient closes their browser during payment.

For better reconciliation with your EHR system, use Stripe's metadata field to attach internal reference numbers. However, avoid storing sensitive patient information or PHI in these fields. For in-person transactions, consider integrating Stripe Terminal with certified card readers at your front desk.

By following these steps, you can build a payment workflow that’s secure, efficient, and tailored to your clinic’s needs.

Technical Considerations for US Clinics

When working with Stripe, always pass payment amounts as integers to avoid rounding errors. For instance, $25.50 should be represented as 2550 cents. The Payment Intents API also supports idempotency, which prevents duplicate charges if the same request is sent multiple times.

Log transaction timestamps in the US format (MM/DD/YYYY, 12-hour clock with AM/PM). This makes it easier for staff to match payments with appointment schedules and patient records.

If your clinic uses a Content Security Policy (CSP) for added web security, make sure to include directives for checkout.stripe.com and *.stripe.com. This will allow Stripe Elements to function without issues. Additionally, if your clinic sells taxable products or services, enable Stripe Tax in the Dashboard. This feature will automatically calculate and collect the correct sales tax rates across different states.

Stripe API Payment Processing Comprehensive Tutorial - Lesson 1

Technical Integration With Worldpay

Worldpay, much like Stripe, requires careful configuration and thorough testing to ensure everything runs smoothly.

Account Setup and System Configuration

To get started with Worldpay, you'll need to sign up for a merchant account and gain access to the Developer Hub, where you'll receive sandbox credentials like your AccountID, AccountToken, ApplicationID, and AcceptorID. Once you've initiated contact, Worldpay assigns an Implementation Consultant and Business Development Manager to guide you through the setup process. This personalized support makes it especially appealing for larger clinics and hospitals navigating more intricate integrations.

After your account is approved (typically within 48 hours), you'll configure payment terminals through the Enterprise Business Center (EBC). These terminals, referred to as "Lanes", can be set up for both physical and virtual payment processing. Clinics with multiple departments or providers can assign unique Merchant IDs (MIDs) or Organization IDs to different terminals, streamlining operations. For instance, you could configure separate lanes for the front desk, dental department, and billing office to simplify reporting and reconciliation.

Additionally, you can customize healthcare-specific fields such as Clinic, Dental, Prescription, Vision, and Total. These fields help track different types of patient payments and generate detailed financial reports. For clinics processing in-person payments, ensure your hardware runs Windows 11 Pro (64-bit) or Linux CentOS Rel 7 (64-bit), as support for Windows 10 ends in October 2025.

Once your system is configured, the next step is selecting the best integration platform for your clinic's needs.

Integration Options and Implementation

Worldpay provides two primary integration platforms tailored for clinics:

- triPOS Direct: This locally-installed solution is ideal for handling in-person payments via EMV chip cards and magnetic stripe readers. Sensitive payment data is kept off your clinic's business software, reducing the scope of PA-DSS compliance. The application and PIN pad operate on the same machine, creating a secure setup with minimal data touchpoints. Worldpay supports several Ingenico Tetra devices for triPOS, including the Lane 3000, 3600, 5000, 7000, and 8000 Deluxe, as well as mobile options like the Move 5000.

- Express XML API: This server-side integration acts as a gateway, offering features like point-to-point encryption (P2PE) and tokenization through Omnitoken or PASS. It's a great option for clinics using custom practice management software or patient portals. The API also supports scheduled and recurring transactions, making it easy to set up installment billing or subscription-based payment plans for patients.

Worldpay also provides tools to enhance payment convenience. For example, Text-to-Pay lets you send secure payment links directly to patients, simplifying the process of collecting post-visit balances or co-pays. Additionally, the Account Updater feature automatically refreshes expired card details for patients on installment plans, reducing the chances of payment declines.

Once your integration is set up, testing in the sandbox environment is essential before going live.

Testing and Certification

Before launching, you'll conduct extensive testing in Worldpay's private sandbox environment, where you can simulate transactions without processing real payments. The sandbox supports up to five transactions per second. Using the Enterprise Business Center (EBC), you can view test transactions and generate Secure Acceptance Keys for both test and live environments. Keep in mind, test keys must be activated within 24 hours of receiving them.

Worldpay provides predefined test values to simulate different transaction outcomes. For example, entering "REFUSED" as the cardholder name triggers a declined payment, while "AUTHORISED" simulates a successful transaction. This allows you to test how your system handles various scenarios, such as displaying error messages for declined payments. To avoid fraud detection issues during testing, vary your test data by using different card numbers and billing addresses.

After completing sandbox testing, Worldpay requires a formal certification process to verify your integration meets security and functionality standards. You'll submit your integration for review, and once certified, you'll need to request a system check through the Business Manager portal before moving to live mode. If your clinic uses the Integrated Payment Server (IPS) with fixed terminals, ensure your POS systems are running websocket-sharp version v1.0.3-rc11 or higher to comply with current standards.

"In addition to being a good partner from a transactional standpoint, Worldpay is very good from an education standpoint regarding compliance and best practices for merchant processing." - John Mitchell, Partner, Radius Media Group

sbb-itb-116e29a

Ensuring Security and Compliance

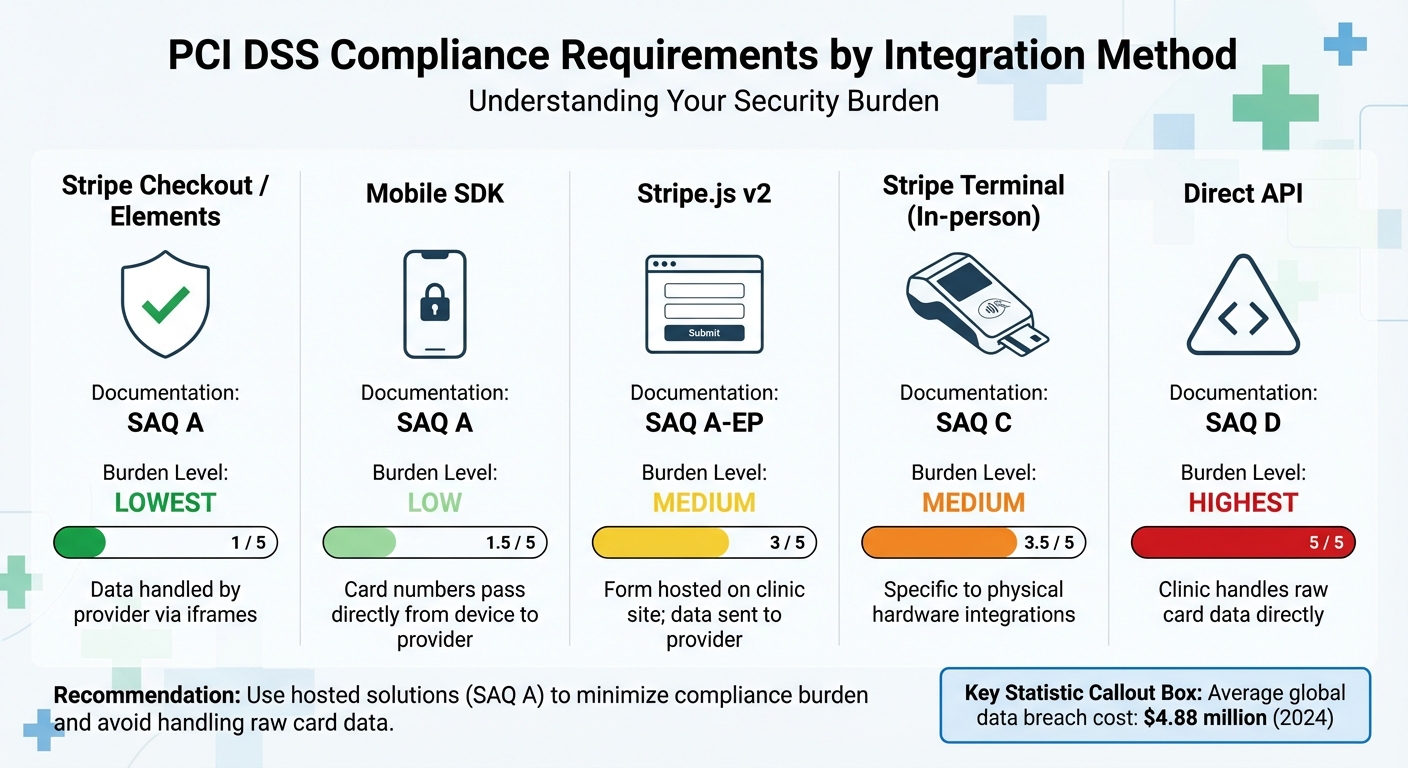

PCI DSS Compliance Requirements by Stripe Integration Method for Clinics

Once you've integrated your payment system, safeguarding patient data becomes a top priority. Healthcare payments must comply with both PCI DSS and HIPAA regulations. Providers like Stripe and Worldpay are certified as PCI Level 1 Service Providers, which means they adhere to the highest standards in the payment industry. However, compliance isn't solely their responsibility - it’s a shared effort. While your payment provider handles much of the technical work, your clinic must ensure that your specific setup aligns with all requirements, including completing an annual attestation. Let’s break down how to meet these compliance obligations.

PCI DSS Compliance in Payment Integrations

PCI DSS outlines 12 essential measures, including firewalls, TLS 1.2+ encryption, role-based access controls, and multifactor authentication. With the average global data breach cost reaching $4.88 million in 2024 and over 10 billion consumer records compromised across 9,000+ breaches in the U.S. since 2005, adhering to these standards is critical.

To simplify compliance, consider using tokenization and hosted payment solutions. Tools like Stripe Checkout, Stripe Elements, or Worldpay's triPOS Direct ensure that sensitive card data never touches your servers. Instead, payment information goes directly from the patient’s browser or terminal to the payment processor. This setup often qualifies your clinic for the easiest validation path, SAQ A (Self-Assessment Questionnaire A), which involves answering just a few questions instead of complying with over 300 security controls.

"PCI compliance is a shared responsibility and applies to both Stripe and your business." - Stripe

Different integration methods come with varying compliance requirements:

| Integration Method | Documentation | Burden |

|---|---|---|

| Stripe Checkout / Elements | SAQ A | Lowest: Data handled by provider via iframes. |

| Mobile SDK | SAQ A | Low: Card numbers pass directly from device to provider. |

| Stripe.js v2 | SAQ A-EP | Medium: Form hosted on clinic site; data sent to provider. |

| Stripe Terminal (In-person) | SAQ C | Medium: Specific to physical hardware integrations. |

| Direct API | SAQ D | Highest: Clinic handles raw card data directly. |

Avoid handling raw card data directly, as this triggers SAQ D and significantly increases your security responsibilities. Always load integration libraries like Stripe.js directly from the provider's domain (e.g., js.stripe.com) and never host or bundle these scripts yourself, as doing so violates PCI compliance.

Additionally, implement network segmentation to isolate the Cardholder Data Environment (CDE) from other systems. Clinics must also perform quarterly vulnerability scans by an Approved Scanning Vendor (ASV) and conduct annual penetration testing to identify and fix security vulnerabilities.

When it comes to storing payment information, the rule is simple: don’t store it unless absolutely necessary. You can safely keep non-sensitive details like card type, the last four digits, and expiration dates, as these fall outside PCI DSS scope. However, storing Primary Account Numbers (PANs) or sensitive authentication data is strictly prohibited. Instead, use tokenization to replace card details with tokens that are meaningless outside your system.

HIPAA Considerations for Payment Data

While PCI DSS focuses on financial data security, HIPAA ensures patient privacy. These frameworks overlap when payment data includes Protected Health Information (PHI) - such as a patient’s name, procedure details, or appointment dates. Systems handling this information must meet stringent privacy standards.

Before processing PHI, ensure a Business Associate Agreement (BAA) is in place. Both Stripe and Worldpay offer BAAs for healthcare clients, so request and sign one before handling payments involving PHI.

Whenever possible, separate PHI from payment data. For instance, use neutral billing terms like "Dental Services - $1,200.00" instead of "Root Canal - $1,200.00" to minimize the exposure of sensitive health details. This approach ensures clear payment records while protecting patient privacy.

Restrict access to PHI and payment data to only those employees who need it. Assign unique user IDs to each staff member and avoid shared logins. Use multifactor authentication (MFA) and automatic logoff features on all devices accessing sensitive data.

"The effectiveness of the training provided to members of the workforce can make the difference between ticking the box of compliance or cultivating a culture of compliance." - Steve Alder, Editor-in-Chief, The HIPAA Journal

Regular staff training is essential. Employees should understand what qualifies as PHI, the importance of strong, unique passwords, and how to identify phishing attempts - a common threat to healthcare records. Designate a Privacy Officer and Security Officer to oversee risk assessments and address privacy concerns. Establish a sanctions policy with clear disciplinary actions for HIPAA violations to reinforce accountability.

Lastly, maintain detailed audit logs that track who accessed electronic PHI (ePHI) and when. These logs should be stored for at least one year and are vital for demonstrating compliance during audits.

US-Specific Operational Details

In the United States, compliance extends to practical operational details. All invoices, receipts, and payment confirmations should display amounts in US dollars ($) using the standard format (e.g., $1,234.56). Configure your integration to use the correct currency code (USD) to avoid processing errors.

For chargebacks - when a patient disputes a charge - have a clear process for responding promptly. Both Stripe and Worldpay provide dashboards for managing chargebacks, where you can submit evidence to dispute claims. Keep thorough records of signed treatment plans, patient communications, and payment authorizations, as these documents are essential for defending against disputes. Preventing chargebacks starts with clear communication and proper documentation.

When sending payment confirmations or balance reminders, use secure communication channels. If using email or SMS to share payment links (e.g., Worldpay’s Text-to-Pay feature), ensure the links are encrypted and set to expire after a specific time. Never include sensitive details like full card numbers in patient-facing communications; instead, reference only the last four digits and the transaction amount.

If your clinic processes payments over the phone (MOTO: Mail Order/Telephone Order), use a PCI-compliant third-party solution to prevent staff from seeing or hearing card data. This keeps your clinic within SAQ A scope and protects both patients and employees. For webhook endpoints that update patient records after payments, always use TLS to secure the data and prevent interception.

Lastly, deploy a Content Security Policy (CSP) with directives like connect-src, frame-src, and script-src to guard against Cross-Site Scripting (XSS) and data injection attacks.

Deployment and Ongoing Optimization

Roll out your tested integration and keep it running smoothly with continuous optimization. Begin by testing a range of scenarios, including successful payments, failed transactions (like invalid card details or insufficient funds), and pending statuses. This ensures your system can handle all possible outcomes effectively. Make sure webhooks are set up to update billing records and send receipts automatically, even if the patient isn’t actively logged in.

Testing and Deployment Strategies

Before moving to production, double-check that all data transmissions use TLS 1.2 or higher for security. Test edge cases such as expired cards or network interruptions to ensure the system can recover without losing critical data. If you're using Worldpay, enable the "Send Idempotency Key" setting to avoid processing the same event multiple times. Replace test API keys with live ones, and run a final smoke test in the live environment to confirm everything is working as expected. Once testing is complete, deploy the system in a controlled manner to ensure a smooth transition to production.

Monitoring and Improving Payment Workflows

After deployment, ongoing monitoring is key to keeping your payment system running efficiently. Use real-time dashboards to track important metrics like payment method performance, accounts receivable aging, and transaction trends. Keep an eye on these metrics to quickly identify issues, such as a payment method that frequently fails. Automating reconciliation - matching bank deposits with your internal records - can help reduce manual errors and make it easier to catch missing funds. Webhooks can also be configured to trigger follow-up actions, such as sending confirmation emails or updating billing records, immediately after a payment is processed, reducing the need for manual staff intervention. Regular testing and monitoring ensure your system remains secure and compliant over time.

"Clinics must prioritize the billing experience alongside the care experience so they don't lose patients to other providers." - Stripe

Train front-desk staff to collect payments at check-in rather than check-out to streamline cash flow and cut down on billing delays. Offering self-service tools like patient portals, text-to-pay options, and in-office kiosks empowers patients to handle payments and view itemized charges on their own, which can reduce the administrative workload for your team.

Leveraging Expert Support

Payment systems are constantly evolving, and staying up to date can be a challenge. Partnering with experts like Scimus can help you keep your integration current without overburdening your IT team. Scimus can take care of ongoing maintenance, implement new features, and ensure compliance with changing standards, such as updates to PCI DSS or HIPAA regulations. With this kind of support, your clinic can focus on delivering quality patient care while maintaining a secure and efficient payment system that grows with your practice.

Conclusion

With the planning, technical setup, and compliance strategies outlined above, your clinic is ready to implement a reliable payment integration system. This process requires thoughtful preparation, accurate execution, and ongoing attention to security. Start by evaluating your existing EHR and practice management systems to ensure smooth data flow while minimizing manual entry errors. Remember, your billing data deserves the same level of protection as patient records.

Opt for straightforward solutions like Stripe Elements or Worldpay's gateway to simplify the setup, avoid handling sensitive card data, and reduce compliance challenges. Use webhooks to efficiently manage post-payment events and ensure a seamless workflow.

Keep a close eye on payments in real time, identify issues quickly, and automate reconciliation processes to safeguard your cash flow. Training your front-desk team on effective payment collection methods is equally essential - this not only sets clear expectations but also minimizes billing frustrations. By following these steps, you’ll establish a streamlined system that supports your clinic's financial health.

"Patients trust you with their health, and that trust extends to how you handle their payments. If the process feels slow, clunky, or confusing, it can damage that trust."

– Stefana Lusse, Fintech Editor, Noda

Consistency and adaptability are critical for long-term success. Collaborating with experts like Scimus can help you stay compliant, adopt new features, and keep your system up to date as payment technologies and regulations change. With a strong foundation and the right support, your clinic’s payment system will stay ahead of the curve, fostering patient trust and contributing to your practice’s growth.

FAQs

How can my clinic ensure payment integration complies with PCI DSS and HIPAA regulations?

To ensure your clinic’s payment system aligns with PCI DSS and HIPAA regulations, start by adopting a secure, token-based payment solution. This approach keeps raw card data out of your systems, significantly reducing your PCI DSS scope and potential risks. These solutions send payment data directly to a PCI Level 1-certified environment, meeting strict security standards while avoiding the need to store sensitive cardholder information on your servers.

For HIPAA compliance, treat any payment-related data linked to a patient as protected health information (PHI). This means you’ll need to implement written policies, appoint privacy and security officers, and train your staff on how to handle PHI appropriately. Partner with a third-party payment processor that offers a Business Associate Agreement (BAA), encrypt all data during transmission, and store only tokenized identifiers instead of raw data. Additionally, conduct regular risk assessments, monitor access logs, and document all compliance efforts to ensure you meet both regulatory frameworks.

By combining secure payment systems with strong PHI protections, you can safeguard sensitive information while staying compliant with U.S. healthcare regulations.

How can my clinic integrate Stripe or Worldpay with our existing systems?

To connect Stripe or Worldpay to your clinic's systems, the first step is setting up a merchant account with your chosen provider. For Stripe, this involves creating an account and enabling the payment methods you plan to accept. If you’re opting for Worldpay, you'll need to establish a merchant profile and link it to your billing software.

Once that's done, you'll need to secure your API credentials. Stripe provides a Publishable Key and Secret Key, while Worldpay will require an API username, password, and merchant ID. Depending on your clinic's needs, you can choose between a pre-built integration for a quicker setup or a custom solution to embed payment processing directly into your software.

To maintain data security standards like PCI-DSS and HIPAA, make sure to use tokenized payment data, enable encryption, and complete any necessary agreements. Before going live, thoroughly test the integration in a sandbox environment to ensure everything functions smoothly for both your clinic and your patients.

When should my clinic hire experts to integrate payment systems like Worldpay or Stripe?

If your clinic’s team doesn’t have the technical know-how to tackle integration tasks like working with SDKs, APIs, or designing custom payment workflows, it might be time to bring in experts. This becomes especially important for handling complex features such as recurring billing, multi-payer support, or tailored checkout processes.

You’ll also want professional help when dealing with compliance requirements like HIPAA or other healthcare regulations. Tasks such as encrypting sensitive payment information, implementing tokenization, and ensuring secure data transfers demand specialized skills. Getting these wrong could lead to costly errors and put patient data at risk.

For more advanced features - think digital wallets, direct debit options, or custom settlement logic - experienced engineers can ensure everything is set up and tested properly. Their expertise not only streamlines the implementation process but also minimizes risks, keeping your clinic’s operations running smoothly while protecting patient information.